What Wells Work at $30?

“A friend in Germany tells me everyone’s panic-buying sausages & cheese. It’s the Wurst Käse scenario” - Bruce Lawson

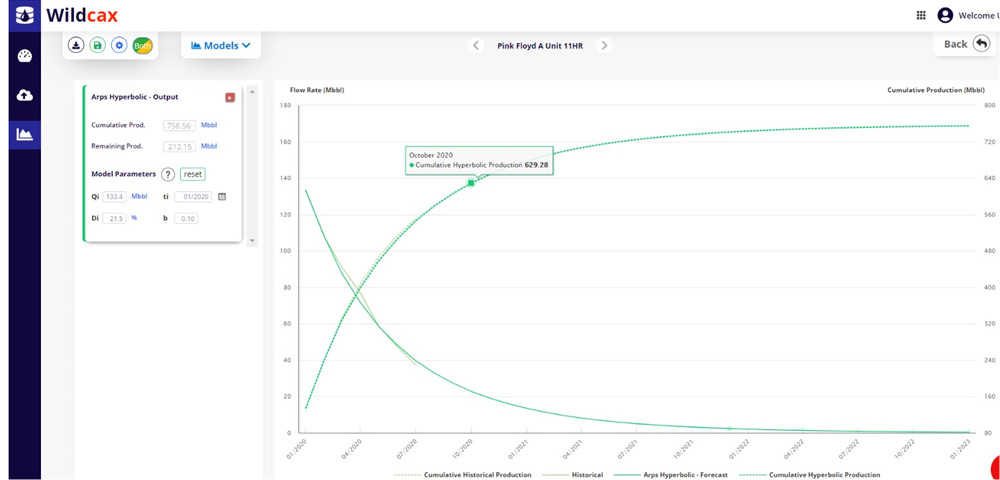

***Editor’s Note: a few of the contributors to this newsletter have been building a DCA tool (Wildcax)- for the last section of today’s newsletter, we used it for a case study on a few of Oxy’s wells***

CRUDE.

We’re not sure there’s been a rougher 2x weeks for oil prices.

Ever.

Western Canadian Select is selling for ~$5/bbl.

WTI hit a 17yr low.

And Wednesday…

Wednesday was INSANE.

Maddening reports like this:

& this:

Posted prices from a few American refiners ranged from ~$2-20/bbl.

In times like this, that Hunter S. Thompson quote comes to mind…

“When the going gets weird, the weird turn pro”

DRW made an appearance on CNBC.

He also published a white paper on oil policy proposals that’s worth a read.

Policies aside, the market is making it’s own proposals -

Tanker rates are multiples higher than a few weeks back & will remain high (as they will be used for storage), due to the widening of the Brent contango.

Even Shell got in on the action & started booking tankers for storage.

Next on the weird list, a few senators wrote this letter to the Crown Prince of KSA, asking for reprieve.

Then, this happened:

“Cramer asked Mnuchin if anyone was calling KSA & saying ‘we protect you and we will not allow you to destroy our oil industry’. Mnuchin said calls were made” - Krishnan

To top off the tank - this statement came out of the Texas Railroad Commission:

“A couple of Texas producers have inquired into the feasibility of the Railroad Commission prorationing production. No formal change in policy has been proposed. Staff is looking into what that change in policy would entail from a practical standpoint at the agency.” Travis McCormick, chief of staff to commission chairman Wayne Christian

What.

A.

Week.

If all of this feels like a lot to follow, well, that’s because IT IS.

After this week - if you still have the stomach for crude news - check out Big_Orrin’s feed for daily updates -

OXY.

Icahn’s still raising hell

Back-to-the-future board moves

None of that looks good.

With shale wells having steep declines, and the futures curve having a ~48mo avg price near $30, we asked ourselves - is any of this worth it?

In that context, we took a look at Oxy’s wells -

WHAT WELLS WORK AT $30: OXY.

First-things-first: we’re not counting acquisition costs.

We doubt 90%+ of shale wells work at these prices, when properly / fully accounted for.

That said, the acquisition costs are sunk costs.

That cash is spent.

Considering that position (which most operators are in), the next question is - can you drill your leases & achieve positive operating cash-flow?

We took historical data from 2019 vintage wells and ran them through our software

Then - to make this interesting - we assumed some pretty generous economic assumptions, with the exception of price, which we ran at $30 flat WTI

For the Decline Curve Analysis, we used a tool that 3x of the contributors of this newsletter have been building - Wildcax.

Wildcax runs custom optimization algorithms on each parameter of DCA models.

Among other things, those algorithms automate much of the process of running a DCA.

Enough so, that you can run 100x wells in 1x click.

Those algorithms are also pretty accurate, too.

You can edit the model parameters - but in this case, we let the computer do the work.

And what we found surprised us.

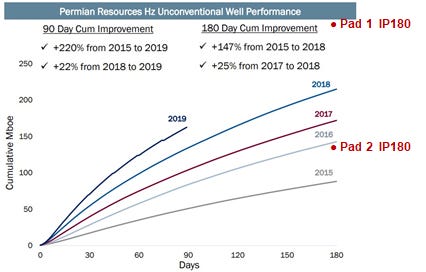

Wells from pads in the same play - same vintage (‘19) - had IP180 rates that varied very widely.

To put it in the context of Oxy’s own forecast, we added the averages to their slide:

The economics - again w/ generous assumptions & ignoring sunk costs - worked with wells from the 1st pad.

At these prices, the 2nd pad should be scrapped (IF it were drilled today).

A stark takeaway was the that production variance from well-to-well was huge.

All shale wells are not created equal.

[We saved the economics / assumptions outputs here]

Our takeaways for Oxy are that:

They have some good wells, that likely generate cash-flow, even at low prices

At the current futures curve - they likely have “drilling locations” that are worth <$0

Their “average well” forecasts may include “wells” that shouldn’t be drilled

***None of this is meant to be investment advice, and no one affiliated w/ this newsletter has any position in Oxy / its debt securities / derivatives***

If you’d like a demo of the software, you can email Matt (matt@wildcax.com) or click this link; we’ve tried our best to make it plug-and-play, so don’t hesitate to sign-up & run DCAs on your own -

That’s it for today - if you’re looking for a sport to gamble on, Belarusian Hockey Finals look like all that’s left - we’ll be back next week, enjoy the quarantine if you can & be well -