US E&P Earnings: Round 1

QEP, Range, Southwestern

“QEP… recorded a net pre-tax gain on sale of $3.5MM, offset by the sale of the corporate aircraft” - QEP

E&P EARNINGS.

The first reports of the E&P Earnings Season are out - we’ll start with QEP.

The Good News:

The majority of their production is oil

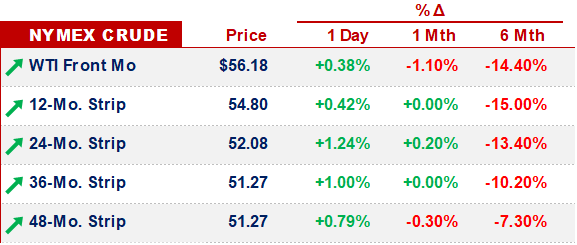

The majority of that production is hedged at >$56/bbl through 2020

The Bad News:

Q3 Gas Realizations came in at $1.13 / Mcf (p. 40)

Q3 NGL Realizations came in at $8.63 / bbl (p. 41)

And… they sold the corporate jet (p. 2)

I’ll give Twitter credit for catching that last bit - the aircraft sale is noteworthy, because without it, QEP would’ve have reported negative cash flow for the quarter.

Despite all negatives, QEP apparently beat the market’s expectations - the stock closed up ~10% after reporting.

Southwestern announced their Q3 results after the market closed. After dropping ~5%, their shares are trading up ~2% after hours, albeit with thin volume.

The Good News:

SWN has had a solid hedging program in place, and will for a while - they use a 3yr rolling hedging program, which in this price environment, looks pretty smart

The Bad News:

“SWN’s realized natural gas price was $1.87 / Mcf, oil realizations were $49.67 / Bbl & NGL realizations were $11.93 / Bbl

“Excluding derivatives, the natural gas differential to NYMEX was $0.78 / Mcf, oil differential to WTI was $9.91 / Bbl & NGL realizations were 16% of WTI”

It’s hard to imagine, in the long term, having a sustainable business with those realizations.

Following their earnings announcement, Range Resources saw their share price drop ~7%; however, by end of day, their share price recovered to close down only ~1%.

Continuing the trend, Range reported abysmal price realizations.

“The average natural gas price, including the impact of basis hedging, was $1.97 / mcf, or $0.26 / mcf below NYMEX. Based on recent pricing, Range expects a fourth quarter 2019 differential of approximately $0.30 below NYMEX.

“Pre-hedge NGL realizations were $15.06 per barrel, or $0.29 per barrel below to a Mont Belvieu weighted barrel, as shown on Supplemental Table 9 on the Company’s website. The third quarter NGL differential to Mont Belvieu was the best in recent Company history. Range expects to maintain a strong differential during fourth quarter 2019 as a result of access to international markets and its diversified portfolio of ethane contracts.

”Crude oil and condensate price realizations, before realized hedges, averaged $49.58 / bbl, or $6.84 below West Texas Intermediate (WTI). Range expects a fourth quarter 2019 oil & condensate pricing differential of approximately $7 below WTI”

[Next week, after EQT reports, we’ll drop a comp table for the Appalachia Gas players]

One final note on Range - the board approved a $100MM share repurchase program. We cannot understand a scenario where, under these operational conditions (low price realizations), that it would make sense to execute share repurchases -

SHALE / INNOVATION.

Jordan Blum, from the Houston Chronicle, reported on a Deloitte publication, highlighting the need for continued innovation for shale drillers.

There’s a couple good quotes in his article that summarize common oil patch issues:

“…the industry must move beyond the “brute force” approach because well productivity has seemingly peaked…

“There’s a “happy medium” between the factory approach favored by the Big Oil giants and the drilling of over-customized and too-expensive bespoke wells…”

We do expect to see more nuanced research & application in the drilling arena.

On that note, Trent Jacobs, from SPE, has launched a podcast covering the subject -

OTHER NEWS.

Petrobras is ramping up production; QoQ output increased >9%

Callon is still fighting Paulson over the proposed Carrizo transaction

Temasek made a bid for a controlling stake in Keppel (parent of Keppel Offshore & Marine)

That’s it for this week - we’re doing 1x question survey on content - click the link if you’d like to request / give feedback on content - hope y’all enjoy the weekend.