The Price Elasticity of an Oversupply

“Too much of anything is bad, but too much good whiskey is barely enough” - Mark Twain

***Editor’s Note: Lost in the WTI headlines… the TX RRC rules on proration today. Considering that prices went negative, they may actually have to vote ‘yes’ on the grounds of waste - we’ll revert back later this week, after the ruling***

***If you find this newsletter helpful, forward it to friend or colleague***

MARKETS.

Yesterday was a reminder that markets are not perfectly efficient:

Look, we love markets - we’ll take ‘em any day, w/ the good & the bad.

We’re just saying that - if you believe in the Efficient Market Hypothesis, then we’ve got a bridge to sell you -

A DIFFERENT GAME.

Yesterday, a variable that’s normally inconsequential in the futures markets, grabbed the deck of cards that the WTI Futures Market normally deals, and threw it out the window.

That variable was Storage

Game night continued. The players remained at the table.

But, the game of poker was over.

Catan was the new game -

In the game of Catan, if there’s a even distribution of resources & odds among the players, relatively even trading ensues

If there’s not - and either one player has a monopoly on a resource, or another has not access to that resource - trades become one-sided…

Fast.

Yesterday, in the WTI Futures Market, a similar situation happened.

Storage was that limited resource.

Some players had it, and some didn’t.

And like ruthless game of Catan, almost no amount cash (Wood) could be traded for storage (a Brick card).

If you’ve played Catan - you know that feeling.

You’re stuck.

You’re screwed.

The more you try to negotiate, the higher the cost gets.

You’re negotiating against yourself… there’s no hope.

The price elasticity of Wood - in this hypothetical - is wholly determined to the willingness of the Brick holder(s) to trade. And that player isn’t budging.

Like a trader with open storage in Cushing…

Yesterday - at least one player in the WTI Futures Market showed up ready to play poker…

… and got taken to the cleaners in a lopsided game of Catan -

NEGATIVE PRICES.

In terms of risk management, we think a lot about draw-down.

Peak-to-trough.

Past & future.

And max draw-down - specifically, the hypothetical max draw-down.

Yesterday, a few risk models probably got blown-up.

For unleveraged equities & commodity futures, zero is your typical / hypothetical bottom.

Even in options, the Black-Scholes pricing model will return an error if the underlying asset has a negative value.

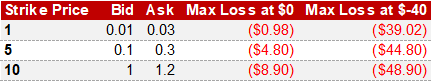

Consider this hysterical situation for someone selling puts (this did not happen):

If zero is your assumption for the absolute bottom on the underlying, then your max loss is a fraction of what it would be, if - you know - prices of the underlying somehow registered a negative value…

…like they did yesterday.

Two weeks ago, someone tried to make a similar bet:

A trader bought 1,000 puts (referencing 1,000 bbl) for $10,000, w/ a $0.50 strike

If that contract was the CME Crude Options Contract, it stopped trading last Thurs

Imagine you’re the option writer:

If you assumed that prices could only go to zero, your max loss on the position - excluding the premium - is $500,000.

But, in the event that prices hit -$40… you’re out $40,000,000

$39,500,000 of that is from after prices go below zero

If we’re reading it right, a trader got someone, or some machine, to make a similar bet two weeks ago.

He missed by 3x days…

… that’s like having a perfect lotto ticket - down to the last number, and scratching a ‘2’ instead of ‘3’ -

RISKS.

Potential issues we see:

E&Ps: Three way collars - that subfloor put at $25…

E&Ps: No buyer for crude

MLPs: Supply contracts are broken

Mineral owners: negative mailbox money?

Traders: Margin calls

Clearing houses: Margin calls

The Exchange: Clearing houses collapse

Code / Risk Model Errors: Systems that aren’t calibrated for negative prices

There’s tons of potential counterpart credit risk w/ the firms that extend credit to the above players…

…but financial regulators seem determined to quash that, at almost any price.

On the other side of the table - tankers, physical traders & refiners (to a lesser extent) should be in relatively good positions -

OTHER NEWS.

Sayonara Supreme Leader? Kimmy is “Grave Danger” following a surgery

Re/credit: like the virus, we expect other countries to follow China’s lead

Consider these comments: on WTI, OPEC+ cheating & counter-party risk

Best jokes of the day:

“After receiving $35k to take 1000 barrels of oil, the CFA textbooks recommend parking the proceeds in a safe negative-yielding sovereign bond” - Matt Thompson

&

“My stop is at -$50 so I'm ok” - Eddy Elfenbein

That’s it for today - we may be back before Friday, but don’t hold your breathe - if you want to watch something other than crude prices, Bosch is back -