The Penn Virginia Doubletake

“Occasionally people will look at me and do a doubletake and they'll look at me like they're trying to think where they know me from” - Nick Hoult

Editor’s note: Day late -

PVAC.

We did a doubletake on PVAC…

Penn Virginia’s wells, and our December look at Magnolia - another oily Eagle Ford E&P - caught our eyes.

PVAC is an Eagle Ford E&P company headquartered in Houston:

The company focuses on Lavaca & Gonzales Counties

Juniper Capital now owns ~60% of PVAC

From PVAC’s most recent operational update:

16,324 bbl/d

20,534 boe/d

80% oil cut

$364MM net debt (the equity is trading at a ~$500MM valuation)

PVAC’s latest reserve report lists 500 future locations:

They own ~91,000 net acres in the EFS

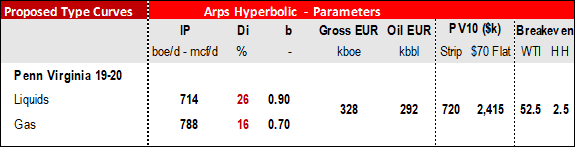

We built out type curve parameters (using ’19 & ’20 vintage wells) with ShaleProfile‘s state-level data.

A $52.5 WTI break-even is pretty good, in our minds.

On a multiples basis, PVAC looked good, too.

On top of that, their well efficiencies have been improving 15% per year over the last 3yrs (on both a total EUR basis & per 1000ft drilled), which is pretty rare.

So, the plan was to write up another (surprisingly boring) story about an E&P just drilling good wells…

…and then we looked at the capital structure…

And we found senior debt, junior debt, preferred shares, dividend restrictions, and a HoldCo / SubCo structure w/ one shareholder controlling 59%…

OK, not so boring.

At this point, we decided to throw the quick-and-dirty analysis out the window and focus on the assets.

So we ran a production forecast & built out the model.

We sensitized what we found:

For this analysis, we ran a prod forecast using 3rd party data, covering 500 operated PDP wells owned by PVAC

The above results represent NAV sensitivities (PDPs + PUDs - $ in MM) of PVAC’s wells

Inventory is drilled over 8 years

Our 2021 Oil Production is 18,209k/bbl

Two major take-aways:

At the current strip, PVAC seems to be overvalued

PVAC is more sensitive to the price of oil than drilling inventory depth

A 25% increase in WTI - from $60 to $75 - translates to a ~100% increase in value:

A good way to value an E&P like PVAC is to apply probabilities to the above table, and take the sum (of the each scenario multiplied by the assigned probability)

Doing so would likely result in a higher valuation than a point-estimate using today’s strip which is in steep backwardation

We expected to see this sensitivity to the price of oil with PVAC.

We did not expect the valuation - at today’s strip - to be so low.

[to be fair, we think Juniper did very well w/ their November investment]

The whiplash from looking at this E&P felt all-too familiar.

US E&Ps are never as simple as they look from the surface (or the screen) -

OTHER NEWS.

Doug Lawler is abruptly retiring

On tax policy - an argument made twice in one week

That’s it for this week - the Ohtani dream has come to life - catch y’all next week -