The Big Short Squeeze

“HOLD THE LINE!” - the r/WallStreetBets battle-cry

***Editor’s note: if you enjoy this newsletter - do us a favor - forward it to friend or colleague***

THE BIG SHORT SQUEEZE.

Undoubtedly, Michael Lewis’s next book will be about the events of last week.

Two simple ideas spurred the madness:

Numerous Hedge Funds bet that GameStop would go bankrupt

*One anonymous Reddit user* thought GameStop was a deep value play

We’ll start this story from the beginning.

A modern-Machiavelli had an idea…

SEPT 8TH, 2019 - THE UNDERDOG.

“Hey Burry thanks a lot for jacking up my cost basis” - u/DeepF***ingValue

In early September, an anonymous Reddit user - DeepF***ingValue - posted a screenshot of a ~$53K long-dated call option trade in the r/WallStreetBets subreddit, along w/ the quote above.

The call options were on GameStop.

The “Burry” reference was to Michael Burry - the hero of Michael Lewis’s “The Big Short” - who disclosed a large position in GameStop.

Another update followed at the end of September -

SEPT 30TH, 2019 - THE MONTHLY UPDATE.

At the end September, DeepF***ingValue posted an update of his original screenshot.

GameStop’s share price closes out the month at $5.52.

He continued to post an update on the last day of every month.

By the end February of 2020, the position was in drawdown…

APRIL 13TH, 2020 - THE BIG SHORT SQUEEZE.

The trade begins to work.

It’s the first time DeepF***ingValue provides the context that there is a short squeeze component to his thesis.

The trade is now up ~200% -

JULY 14TH, 2020 - ROARING KITTY.

A YouTube channel - focused on investing - by the name of “Roaring Kitty” emerges.

The anonymous host describes himself as:

“I'm probably best classified as a fundamentals-focused deep value investor”

AUGUST 21ST, 2020 - THE CALL.

In a video titled “The Big Short SQUEEZE from $5 to $50? Could GameStop stock (GME) explode higher?”, the host of the Roaring Kitty YouTube channel delivers a 5min GameStop pitch.

In hindsight, this is an epic call -

NOVEMBER 16, 2020 - THE CATALYST.

The former CEO of Chewy, Ryan Cohen, acquires ~10% of GameStop & sends a letter to the board.

Cohen calls for the board to seek a strategy that is coincidentally similar to the Roaring Kitty’s value investment thesis.

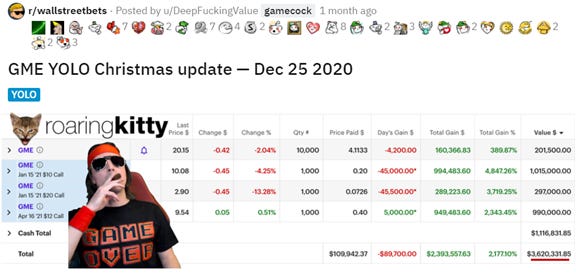

CHRISTMAS DAY.

The anonymous Reddit user DeepF***ingValue outs himself as the host of the Roaring Kitty.

We now have a face, but no name.

His GameStop position was now worth $3.6MM -

JANUARY 11TH, 2021.

Ryan Cohen joins the GameStop board.

GameStops’s share price rises from ~$20 on Jan 11th to ~$40 on the 14th.

A portion of DeepF***ingValue’s calls expire on Jan 15th.

DeepF***ingValue closes those calls, up 15,000% on those contracts alone.

The Big Short Squeeze is only beginning -

JANUARY 25TH.

At this point, the >2MM members of the r/WallStreetBets subreddit are worshipping DeepF***ingValue like a cult does its leader.

At the same time, the WSB cult also realizes the trade isn’t over.

They had identified that short-sellers were still short GameStop more than there were shares outstanding.

The community bands together - buying shares of GameStop - perpetuating the squeeze & driving up the price.

Melvin Capital - a large fund that is short GameStop - is bailed out by two other hedge funds.

All the while, Davos (the World Economic Forum) is underway, and *NO ONE is watching*.

A group a message-board traders are dominating headlines - the talk is that their trade is threatening the survival of major market participants.

GameStop’s share price closes *at >$76* -

JANUARY 29TH.

The will of the members of the r/WallStreetBets subreddit to hold their positions - perpetuating the short squeeze - is unprecedented.

Even hedge funds join the trade.

The trade becomes a gigantic coordination game.

Their battle-cry of “HOLD THE LINE!” - as in, ‘don’t sell’ - enables a giant Nash Equilibria.

The fallout is profound:

Citron Research discontinues short selling research

Retail brokerages straggle to post margin to clearing houses

Subsequent trading restrictions cause national outrage

r/WallStreetBets gains 6MM new members

**GameStop’s share price closes the week out at $328**

And our hero is doxxed - his name is Keith Gill, a 34yr old dad who lives Boston -

TODAY - THE FALL OUT.

Pre-market, GameStop’s share price is still trading at ~$170 per share.

The squeeze is still alive, but losing steam.

Last week had consequences.

But it also shined a light on how markets are behaving, and - more importantly - how they are *not behaving*.

We’ll close w/ our noteworthy takeaways:

Asset prices are not necessarily representing fundamentals, especially on the downside

Short & Long/Short strategies are much more difficult than in the past

Hedge funds de-leveraged / de-grossed, perhaps permanently

Reddit/WSB can easily pump an asset price

That’s it for this week - hopefully things cool-off & we can get back to oil - catch y’all next Tuesday -