Shelter-Production-In-Place

“…what we’re looking at right now… is, sometime in April, running out of storage, because more oil is pouring into the system - ultimately by the end of April - than we can store” - Daniel Yergin [on CNBC, yesterday]

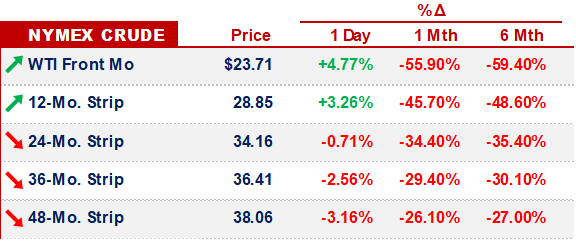

CRUDE / PRODUCTS.

The EU is on lock-down

The US is heading towards shelter-in-place

And, India’s not far behind

Combined, these 3x economies represent nearly 40% of the world’s daily oil consumption.

And on Monday, the products market recognized this.

RBOB hit a new all-time low - 41.18 cents/gal…

…a 32% drop… from FRIDAY.

Gasoline cracks turned negative.

Refiners, in the US & Europe, scrambled.

When margins turn negative, capacity needs to be cut -

E&Ps.

A reality of humanity is that people tend to like the things that they do well.

And often, when there’s uncertainty, people will - by default - do that thing.

**This behavior is the only explanation that we can come up with to describe why wells are still being drilled**

And right now, that behavior is prolonging an absurd game of chicken.

US & Canadian E&Ps are riding toy tricycles - head on - at a Humvee, driven by Saudis & Russians.

And that Humvee has enough fuel in the tank to drive at full speed through Q4.

Yesterday, the Bank of America team published a comprehensive description of the current situation:

“With negligible net debt at year end 2019, we suggest Aramco could maintain its strategy for an extended period with no material impact on the Saudi fiscal budget as its 98.5% share of the dividend would still be paid from the Aramco balance sheet, regardless of oil price. The bottom line is if this strategy has permanence, Saudi can sustain production at 12mm bpd for an extended period” - BAML

& this:

“The problem as we see it is that a return to absolute growth at rates competitive with the broader industrial sector risks a return of outsize oil growth, repeating the cycle that ultimately led Russia & OPEC to abandon its interventionist policy that has supported oil prices from late 2017. At that time US E&P managements took the recovery in prices as a green light to restart investment, with annual growth targets routinely above 10%. This is irrespective of the fact that the economics were being essentially subsidized by OPEC+ (Saudi / Russia) production cuts and in hindsight it is probably not unreasonable that Saudi / Russia has taken the collapse in demand associated with the Coronavirus as an opportunity to retake market share irresponsibly assumed by upstart US shale players.”

“Given this is the second time this has happened in five years, if there is any recovery in oil prices, we doubt the market will accept a strategy from any management teams that once again pursue growth in oil production above levels that the market can tolerate” - BAML

In 2020 terminology, E&Ps need to “shelter-in-place” -

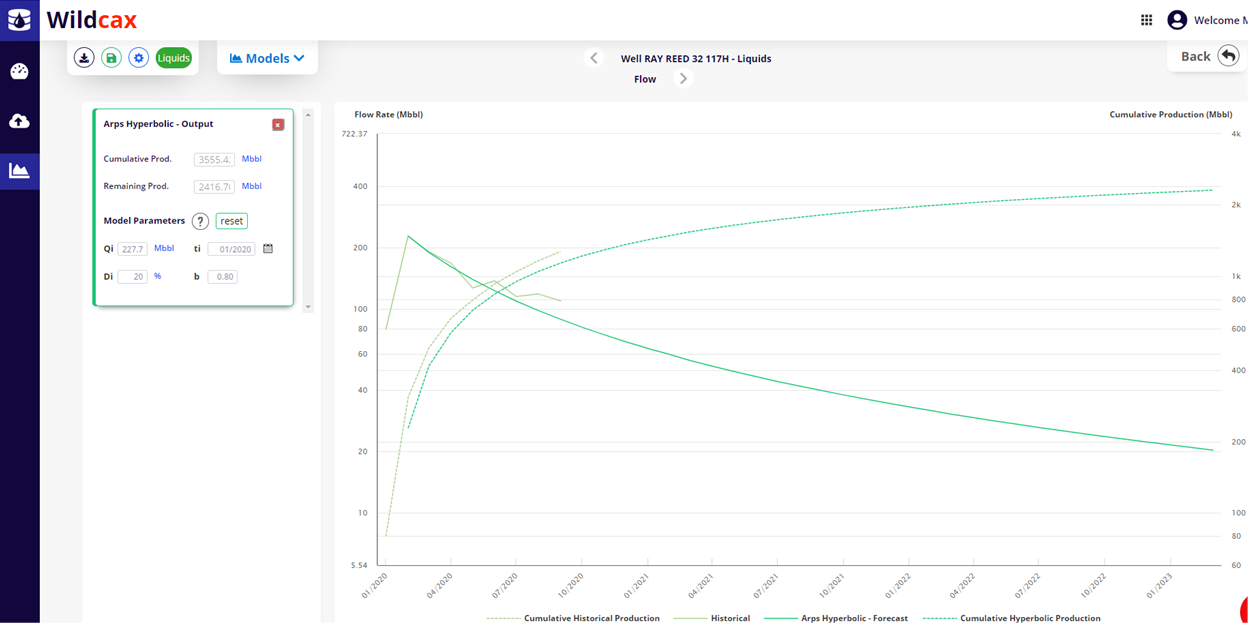

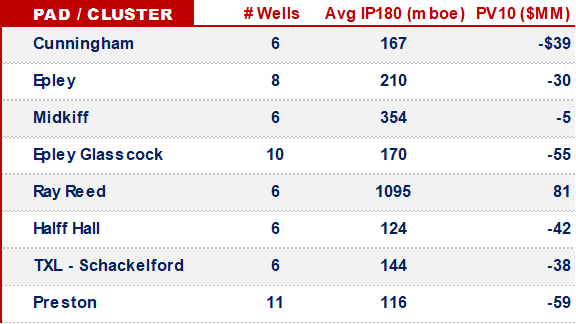

WHAT WELLS WORK AT $30: PIONEER.

Looks like we’re going make a series out of it.

Last week, we laid out the rules of the game:

Sunk costs are sunk (& excluded)

Used 2019 vintage wells

WTI, flat @$30/bbl

Like Oxy, we found that Pioneer’s IP180 rates varied widely.

For comparison’s sake, we ran a few pads at $50/bbl.

Of note, that Epley pad / cluster had a PV10 of ~$40MM at $50.

Same-old-story: Price, price, price -

OTHER NEWS.

Sanchez Energy’s DIP loan may be impaired

AMLO makes American politicians look like angels

Vaccine timing Tracker / Data

Spice up your Quarantine w/ a Quaranstream

That’s it for today - we’ll be sheltering-in-place until Friday - catch y’all then -