Shale Survey Results

“Dangers await only those who do not react to life” - Gorbachev

***If you enjoy this newsletter, do us a favor - send it to a friend or colleague***

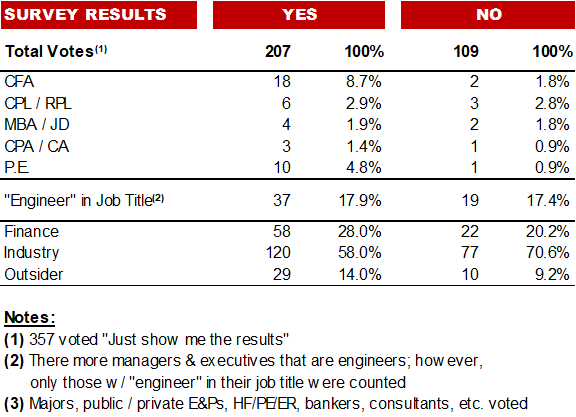

SURVEY RESULTS.

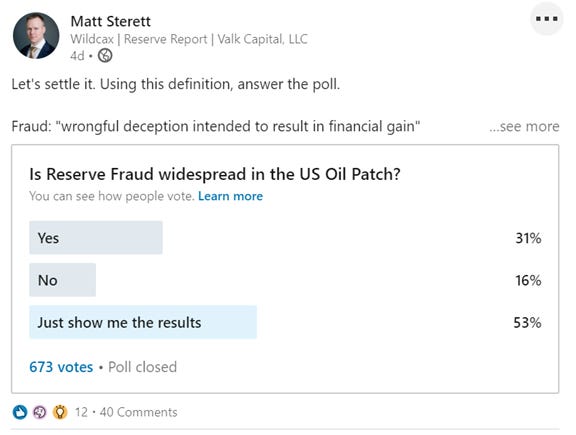

On Friday, we ran a survey on LinkedIn.

We debated whether we should ask the question publicly.

In the end, that we had to ask ourselves if it was appropriate to ask the question was determined to be reason enough to ask it:

We’d like to thank everyone who voted - especially those who opined in the comments.

Most serious problems are complicated enough that there’s not a simple “Yes” or “No” answer.

That said, the number of “Yes” votes - from this survey - should be grounds for taking the question seriously.

Voter takeaways:

We don’t typically like more rules & regulations, so we’re advocating for industry action.

And it’s not that we root against policy-makers; it’s that we think making policy (that achieves the intended outcome) is extremely challenging.

So - if you have the time to read the comments & think these results are a cause for concern - share the conversation with w/ your peers.

While the past is the past, it doesn’t have to repeat itself -

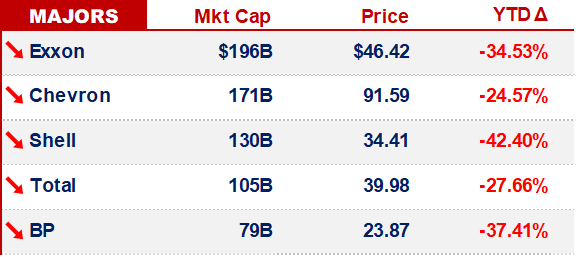

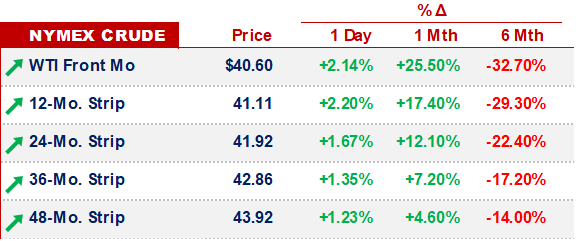

DELOITTE REPORT.

Deloitte published a report (PDF link) on shale that’s making headlines.

Those headlines aside, the report presents concise explanations of relevant (for shale) accounting mechanics & their implications, including:

“One may argue against reading too much into this ‘noncash’ impairment figure of companies. Yes, it’s just an accounting adjustment. But it translates into writing off the invested shareholder’s equity and carrying a debt that may have been taken to develop or acquire the impaired asset. The result: an immediate increase in the industry’s leverage ratio from 40 to 54 percent”

&

“In the first half of 2020, companies following the successful efforts (SE) accounting method will likely report significant impairment due to a lower future price strip. Either proactively or led by auditors & bankers, a significant portion of the SE companies’ carrying amount may not be recoverable and thus would need to be impaired immediately.”

“The companies, along with their auditors, should evaluate the long-term impact on the recoverable volumes for shut-in assets and assess whether restart capital will be required once prices recover. Both companies & auditors would be judged for their fair-value disclosures, changes in accounting estimates, reserve adjustments, and early warning disclosures”

While accounting doesn’t change the operations of an E&P, it can affect financing.

All things considered, the report is very readable…

…which (due to their technical nature) isn’t something that’s often said about Big-4 presentations -

OTHER NEWS.

Talos making moves

New Mexico & Oil Revenue

Rugby is back & this guy was NOT ready for it - catch y’all Friday -