Noble, & the RBL Fire Sale

“The primary objective of this sale is to continue de-risking our loan portfolio by accelerating the disposition of assets that have been impacted by ongoing issues within the energy industry” - John Hairston, CEO of Hancock Whitney Bank

RBL FIRE SALE.

The price of oil doubles…

…and the RBL marks **halve**…

Hancock Whitney (HWC) sold their entire RBL book for ~fifty-cents-on-the-dollar - and, in the process - probably disclosed too much information (PDF)…

In addition to their RBL portfolio, HWC also sold out of almost all of their midstream portfolio:

While we don’t invest in banks…

… we can say that we are seeing OFS obligations all over Ch.11 filings.

Therefore, we expected further write-offs.

Albeit probably not material to HWC.

On the other hand…

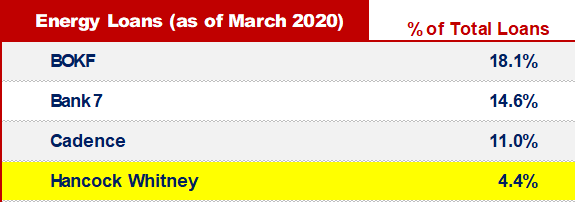

These banks have similar energy loan portfolios to HWC.

With multiples more exposure to energy loans -

It’s not news that banks have been trying to sell the risk.

And now, we have the market clearing price.

Which begs the question…

Does that price bring down these banks?

NOBLE.

Chevron is buying Noble in an all-stock transaction, at a 7.5% premium to Friday’s close.

We’re not sure we can recall a $5BN all-stock transaction w/ a premium <10%.

There’s a few things going here that are worth noting…

Noble’s primary asset is an off-shore Israeli gas field.

Considering the nature of the Middle East Petro-Economy, having an Israeli asset / doing business w/ Israel meant that you had to plan to own the asset.

No Exit-Ops.

No Flips.

Why would a Major risk upsetting their larger OPEC member clients / partners?

Fortunately for Noble, the situation shifted.

Unfortunately, it took war to change the answer to that question.

The Syria & Yemen civil wars have created unlikely allies…

In the spirit of the enemy-of-my-enemy-is-my-friend, Israeli & major Sunni OPEC members have - recently - seen surprisingly cooperative political / economic relations.

And Chevron doesn’t have that much (relative) exposure to Sunni OPEC:

We suspect Chevron looked at this asset for a while.

They clearly understood their position at the table.

Perhaps - *the only buyer* -

And - that, if no offer was accepted - that there may not be another chance (ever) for Noble to sell.

The transactions terms reflect this reality.

Our best-guess ($MM) of Noble’s Israeli Assets @ $4 Local Gas

The IOCs are feeling political pressure to buy cleaner hydrocarbons (i.e. gas).

And the big gas projects have decent economics (above), assuming some level of price recovery.

However, the political pressure being applied to IOCs will likely force an over-investment in gas…

So, we’re not counting on those potential economics being realized.

But, we are counting on gas assets being bought.

And we won’t be surprised if Kosmos goes next -

OTHER NEWS.

Bruin filed for bankruptcy

BJ Services filed

More pipeline issues

A fake Denbury buyout PR

More write-downs, down-under

A reminder about Reserves, from Thad Toups

NHL Training Camps are going on (on NBC) - playoffs start up in August - that’s it for today, we’ll be back on Friday - catch y’all then -