Magnolia Asset Review

“One can hope for $75 oil, but I think one has to plan for a lower price” – Stephen Chazen

***If you enjoy this newsletter, do us a favor - send it to a friend or colleague***

PDF Version: Google Drive Link

MAGNOLIA (MGY).

MGY is an Eagle Ford / Austin Chalk E&P company headquartered in Houston:

The company focuses Karnes County & the Giddings Field

Magnolia is the result of a TPG SPAC that combined with EnerVest assets

MGY is led by Stephen Chazen, OXY’s former CEO

From MGY’s most recent 10-Q:

27,016 bbl/d

54,306 boe/d

50% oil cut

MGY’s latest reserve report lists 1,630 gross wells:

They own ~24,000 acres in Karnes County & ~440,000 acres in the Giddings Field

The majority of their wells are non-op (w/ EOG being the operator on ~75%)

We identified ~52% of MGY’s production via data from public filings

The 30,000-foot view is straightforward:

Cheap wells

Very good management

Low debt load (undrawn revolver + $400MM in notes due in ’26)

Emerging play w/ significant acreage to drill out

KARNES COUNTY.

Historically, Karnes County has been Magnolia’s core operating area.

We built out type curve parameters (using ’19 & ’20 vintage wells) with ShaleProfile‘s state-level data, and the breakeven numbers look pretty good:

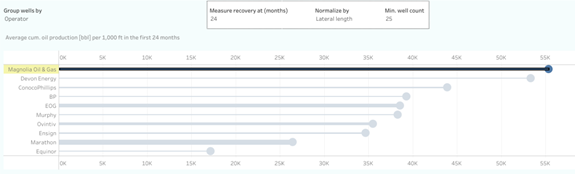

Our next step was to compare Magnolia’s Karnes County well productivity to its peers:

Contact Enno at ShaleProfile for a trial

It’s clear as day that Magnolia figured out how to drill Karnes County.

So, why move on from that play?

*Low Inventory*

Contact Tom at FLOW for a demo

Magnolia has been drilling much denser than its peers. Despite the downspacing risk, their rock has handled the high well density.

That said, MGY would not be doing this / taking this risk if they had more drilling locations in Karnes.

So, Magnolia has started drilling out their other play…

GIDDINGS FIELD.

Like Karnes, we built out type curve parameters using ShaleProfile‘s state-level data.

This time, we broke out type curves by vintage:

Data from ShaleProfile

For anyone who’s been following US Shale, a major known issue is that much of the good rock has been drilled.

Vintage well performance has – in many cases – gotten worse over time.

Magnolia’s new Giddings Field play is showing the opposite trend.

Their 2019 wells were garbage.

But the 2020 wells look good.

MGY Giddings Field Cum Prod:

Data from ShaleProfile

CONCLUSION.

Magnolia is the first US Shale E&P that we’ve looked at closely in 2020 where *the assets support the capital structure*.

We ran a PDP forecast - discounting it at 10% - and compared it to their most recent reserve report.

For the wells they operate (we backed-out non-op), we actually agree with their PDP reserve audit!

For this analysis, we ran a prod forecast using 3rd party data, covering 297 operated wells owned by MGY

We ID’d 28kboe or 52% of MGY’s Q3 net production via data from public filings – Q3 prod was 54kboe

We attribute the difference to Magnolia’s extensive non-op portfolio - they own WI in 1630 wells

We did not see *that* coming [btw, their auditor is Miller and Lents].

The main risk in Magnolia is the development of the Giddings Field.

Right now, it looks good.

But MGY’s market cap is almost $2BN…

…and WTI is in backwardation.

To catch up to *that valuation*, either Giddings needs to hit big (they have 400k+ acres to play with), or crude prices needs to rise.

Or both -

That’s it for this week - we’ll be back in the New Year - enjoy the Christmas / Winter Holiday break - catch y’all in 2021 -