Gulfport Ch.11

Pipe Dreams & Pipelines

“We expect to exit the Chapter 11 process with leverage below two times & rapidly delever thereafter…” - David Wood [Gulfport CEO]

***If you enjoy this newsletter, do us a favor - send it to a friend or colleague***

Gulfport Filing Links:

Gulfport Restructuring links

10K, RSA & other exhibits

Ch.11 Case Files

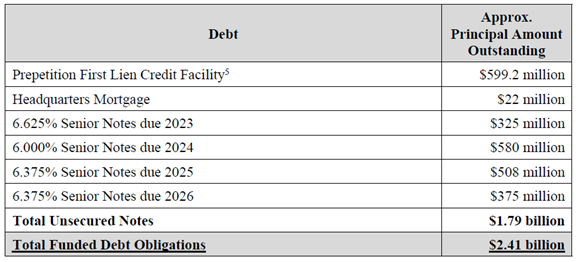

Prepetition Capital Structure:

RSA Notes:

$262.5MM DIP

Rights Offering of at least $50MM

Unsecured gets $550MM of new notes + 100% of New Equity

Existing Equity gets $0.00

Twitter Commentary:

GULFPORT CH 11.

After 6 pages of describing the series events that led to Gulfport’s Ch.11 filing, CFO Quentin Hicks signed off on this gem of a statement:

“Even worse, the sole counterparty that agreed to an amendment during the summer period, Midship Pipeline Company (“Midship”), after pleading with the Debtors to preserve that amendment before beginning a renegotiation, breached its agreements and further depleted the Debtors’ liquidity.

“Upon receiving a $32.9MM prepayment as provided under the recent amendment, Midship refused to reduce its credit support and drew down in full the $75.6MM letter of credit under the prior agreement. This resulted in Midship receiving $108.5MM in cash from the Debtors when it was only entitled to $79.2MM.

“Midship’s brazen breach, for the bald purpose of obtaining leverage against the Debtors during their restructuring” - Docket 40, (pg 8)

Midship v Gulfport - a Midstream Contract Battle:

Midship (a Cheniere sub) is seeking a exemption to the right of rejection to break contract via FERC:

Gulfport wants to break contract in Ch.11

Midship attempted FERC intervention

Jurisdiction btw FERC & bankruptcy courts is currently being heard in the Federal Court of Appeals

But FERC aside - based on Hicks’ statement - it appears that Midship pulled a fast one on Gulfport & their creditors w/ the LC draw.

All of this over a pipeline that went into service *in Q2*…

What brought down Gulfport was the unrealized (pipe) dreams from this presentation.

We took a look Gulfport’s SCOOP operations - we found 72 operated wells.

It’s ugly…

SCOOP Assets Summary:

PV10 remaining wells ID’d is ~$105MM

Conservatively, they’ve probably lost $55MM+, net, drilling these SCOOP wells

Acquired it for ~$1.8BN (did come w/ some production)

Ultimately (w/ favorable assumptions), they’ll make money on ~2/5 wells drilled

Output data from ShaleProfile’s economics dashboard, message Enno & start a trial

Gulfport - *on their own website* - claims that their SCOOP operations have 1.3 Net Tcfe of net *proved reserves* from 400+ net locations…

Yeah, *right*, and we have a bridge in Brooklyn to sell you -

OTHER NEWS.

Today, OPEC’s Joint Ministerial Monitoring Committee meets. On Nov 30th, OPEC meets, followed by an OPEC+ meeting on Dec 1st.

Cuts are expected to be extended. Amena & Javier will almost certainly be covering all three meetings live, on Twitter -

SM’s STX DrillCo deal & borrowing base reaffirmation

PNC buys BBVA’s US business

If Barings brings back bad memories, then *don’t* read this tweet (h/t to @james_ritzema for the find)

That’s it for this week - DeAndre Hopkins caught the best game-winning Hail Mary since the Miracle in Motown… it’s worth watching twice - catch y’all next week -