FANG Reports

M&A and a beat

"It's important not to overreact to this volatility in prices resulting from the unique circumstances of the pandemic" - John Williams [NY Fed President]

Editor’s note: A few weeks ago, we were alerted to the fact that the spot price of bee-tee-cee traded below the CME futures contracts. On the surface, that’s free money.

We’re guessing a few of you were also aware - here’s the best thread we’ve seen on the trade (and its risks).

OK - back to oil -

Q1.

Diamondback reported Q1 adjusted EPS & EBITDA of $2.30 & $836MM, beating consensus estimates of $1.83 & $740MM.

M&A was the story.

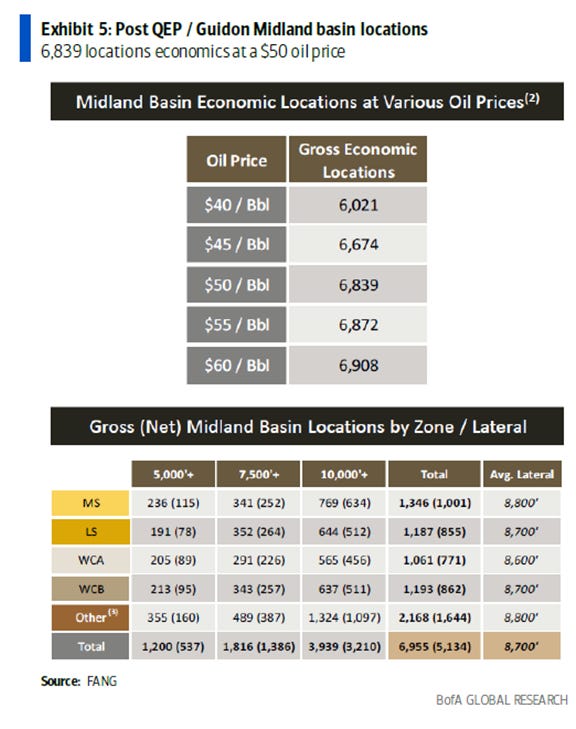

This is the 1st quarter post the QEP / Guidon acquisitions

Diamondback also announced two divestures

Oasis (emerged from Ch.11 in Nov) is buying Diamondback’s Williston Basin assets for ~$745MM, financed entirely by debt (via their RBL & a bridge).

Considering recent history, that’s aggressive.

Diamondback also sold a small chunk of non-core Permian assets for $87MM.

Hedging hurt a bit, and will continue to - throughout 2021 - at these oil price levels.

[re/ FANG: we liked the presentation of the tables (above) from BAML]

From the other side of the world, Aramco reported Q1 net income of $21.7BN (also beating consensus estimates).

When you produce numbers like *that*, you get to skip the analyst Q&A call.

And Aramco is doing just that.

Later today, Conoco, CDEV, PVAC, Pioneer, & Devon report, among others -

OTHER NEWS.

Mohamed El-Erian has recently made a few good points about the Fed, bank policy distortions, & global supply chain issues. We think the latter faces structural / policy concerns going forward, even if (or when) short-term issues are addressed.

And we don’t think that’s a good thing.

That’s it for this week - hope y’all enjoy Cinco de Mayo w/ a couple Mexican Martinis - catch y’all next week -