E&P Catch 22

“Knowledge is literally prediction. Knowledge is anything that increases your ability to predict the outcome. Literally everything you do, you’re trying to predict the right thing. Most people just do it subconsciously” - Daryl Morey

***Clint Barnette was kind enough to share his notes from this week’s SPE A&D Symposium - they’re the last section of today’s newsletter. If you like his notes, follow Clint on Twitter. Matt was also at the event - his notes from are included as well***

MELTDOWN.

10yr yld: all-time low

30yr yld: all-time low

XOP: all-time low on Mon, down 16% since

Long-story-short, the market is increasingly adopting our views on the coronavirus (we’ve beaten that topic to death).

RATES:

If the US stock market rises between July 31 & October 31, the incumbent party wins the US presidential election >80% of the time

The Trump administration knows this, and will use the biggest tool at their disposal - the Federal Reserve - to achieve that

We would too.

The first point alone makes a case to be long IG bonds in any presidential election year.

Throw in a pandemic, and it’ll make you a contender for fixed income manager of the year -

Now that we’re past that…

WHOA.

What a week.

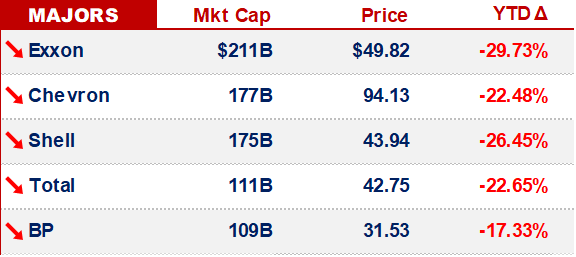

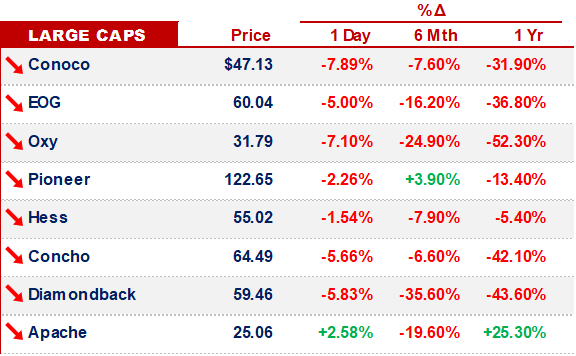

Oil-world aside, equity markets around the world have tumbled ~5-15%.

We’re expecting further loses today.

As much as mean-reverting buyers may buy, we don’t see the active human component of the US equity markets carrying any more risk over the weekend than it has to -

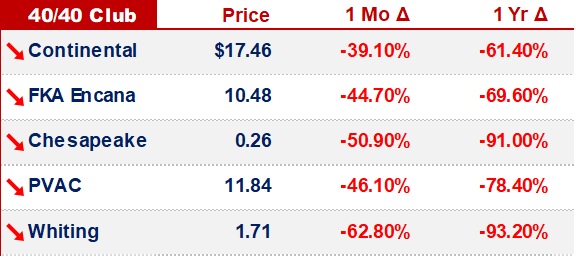

40/40 CLUB.

Not that 40-40 Club.

We’re not talking about Jay-Z’s 40/40 Club, either.

We’ve witnessed a 40/40 club emerge in US E&Ps - where their share price is down at least 40% in the last month, and much more than 40% for the last year.

To us, this indicates that:

these assets were not as advertised; or

there’s a lack of confidence in management; or

both

Early on Thursday, Continental hit that threshold, before clawing back a bit of its dive in share price.

The Continental situation was noteworthy - and we’ll get to that in a minute - but first, it’s worth taking note of these 2x events:

Gulfport missed a zero in last quarter’s earnings (well, it’s actually losses).

You can’t make this stuff up.

Gulfport actually made our 40/40 list, but we’ll let them check their books one more time before we add ‘em.

Not sure what that D&O policy looks like…

(B) Whiting:

ETF has said everything there is to say about Whiting…

And if you listened, you made $$$.

Now - back to Continental -

CLR.

Continental used to be on this list.

They’re not now, for reasons including:

And this:

We ran an NAV analysis on Continental.

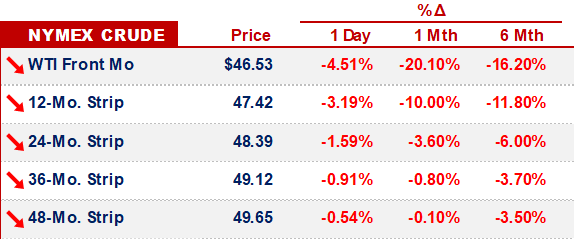

At the current WTI strip, w/ gas $2, we found that a 10% decrease in well production decreased NAV by ~25%.

Something that might happen in a parent-child well situation…

You know… the kind of down-spacing issues exhibited by Concho’s Dominator pad.

At the end of the day - like Comstock (Jerry Jones) - Continental is majority owned by one individual: Harold Hamm.

And - more or less - he can do as he pleases.

It’s your choice to join him…

SPE-GCS A&D SYMPOSIUM.

Again - thanks to Clint Barnette for his notes - we’ve included them 1st, followed by Matt’s notes.

From Clint:

Jason Martinez: Managing Director & Head of US A&D, BMO Capital Markets

What he’s seeing?

Cost of doing business is higher than normal, debt yields are 12-14%

Drill Best stuff now, fewer science projects

For loan portfolio and future debt… what BMO looks for: Payback in 4-5 years, 80-90% hedged, can’t top 2x debt on an oil deal, 1.5x debt on a gas deal

PDP risking has increased for transactions, but vast majority of winning PDP bids make PDP PV10 offer. From 25x company dataset that BMO transacted on last year

Per BMO’s analysis… Boomtown/Rocky Creek transacted at 70MM PDP, 115MM upside, only deal with substantial value to upside lately

BAC moderated Permian panel: Pat Wagner MRO, Chris Paulson PXD, Mike Hinson PE

PXD/Sinochem JV mentioned first, started courting international buyers early on in 2011 or so. Took a long time to get them comfortable with a Permian presence

Nothing really notable in this round table outside of that

Capital Markets/Debt Finance Panel: Mary Kogut Brawley K&E, Kristan Spivey, RBC, Kristin Kelly EIG, Lawrence Martin, Citi [best panel of the day by far]

How are institutions reacting to A&D deal metrics?

Valuation push back on puds/undeveloped

Markets are essentially closed

What’s the PV15/PV18 or prod? Trying to define downside risk compared to positioning for upside

Trying to fill out an entire syndicate for debt is tough… even if a bank likes a debt deal, very few banks open for business and nobody wants to take 100% of a debt deal

Borrowing base season fall 2019

Reaffirmed 50%, increased 25%, decreased 25%.

Decreases weren’t really surprising, those decreased were already distressed deals

In the past 6x months, terms have tightened. R/P decreased to 2.5x from 3.5x, gas producers being forced to hedge

Banks are asking for higher % interest rates (and getting them)

How relevant is a borrowing base value when PDP transacts at a higher #? What is the realized collateral worth?

They’re focused on core areas with full development (who isn’t?), trying to focus more on downside protection instead of exposure to upside

Banks are trying to be elastic, engineers being more discerning. Blowing down just PDP is tough to do with debt covenants

What about hedge funds being involved?

Lenders prefer to not have funds involved, makes borrowing base messy and misaligned with mgmt team

How to deal with under-performing assets in portfolio?

Case by case deal, if the fair market value is too small to sell the bank has to figure it out

Tough to get syndicate aligned for a decision, in a lot of cases they’d rather have the asset sit and wait it out

Deals must be in the right zip code to stand a chance of financing

Dry gas needs 3x years of hedging at the start of a deal, some of those deals with yield obligations require 5x years of hedging

Nobody wants to hedge at $1.80 gas, so how to protect downside?

Oil deals won’t require forced hedging if the zip code is good

Entire credit advance on transactions will be on PDP, terms are tighter and getting banks on board early is key to getting an acquisition done in this environment. Be realistic

Eagle Ford Panel: Marty Thalken CEO Protege, Carlton Ellis Magnolia VP of BD, Brett Pennington CEO of Ensign

Protege:

Now yielding 12% annually

Investing 60% in D+C, remainder paying down debt & spitting yield.

“Magnolia-esque”

Now a FCF company after failed process

Ensign:

Since May 6th closing, Ensign has doubled production

Protege:

They think a bottom in service co pricing is in, tougher to get spot crews because so much equipment is being laid down

They are better at protecting parent wells, parents on average are same to better from infill child wells at 500’ spacing

Infills are 20-80% better than parents, and they’re not over stimulating child wells

They calculate parent well’s frac effectiveness on frac sand placed per acre

Ensign:

Cost reduction still to come in materials, day rates have flattened

11,000’ TVD wells are going down in 11-14 days

Trying new technology on the surface to make zipper fracs go faster, knocking out 8-9 frac stages a day due to new technology. What tech??

What’s the role that PE plays in the Eagle Ford?

Protege:

Encap views uninvested funds as precious capital….

They’re investing in best economics across the entire portfolio

Protege assets compete favorably in Encap’s portfolio since they’re fully developing at $50 oil

Ensign:

Long term Eagle Ford view from Warburg & Kayne, if you operate properly you can make long term value work

Not built to flip

The only thing you can control is your costs, focus on what you can do to make things better

Magnolia:

Avoid big deals for M&A, can’t sacrifice their existing inventory quality to do M&A

Lots of transactional hold up from PE firms on what their “mark” is on the value of the asset

Don’t want to have their come to Jesus moment

Running 1x rig in Giddings, going up to 2x rigs later this year

Extremely encouraged by delineation so far

Protege:

EOR will be successful in the Eagle Ford & in their area

The Eagle Ford has a lot of room to improve via field optimization and EOR

Inventory life for the Eagle Ford:

Core depletion is real in the eagle ford, inventory life is measured by drilling rate

Don’t need high production growth to work

Giddings - tech is on your side, recovery will only improve over time

PDP Investing: Art Krasny Wells Fargo, Jay Graham CEO of Spur, Jason Lindmark VP of BD at Merit, Mark Teshoian MD at Kayne Anderson

Merit Energy:

130,000 boepd over 8 states

Been around since 1989

Each acquisition must stand on its own

Raised its 30th fund with $1.3B to spend

Jay Graham (Spur):

17x people carried over from Spur

1x rig running

He’s pretty bored with the distribution model...

Would rather take the Wildhorse deal back than the Chesapeake stock

Mark Teshoian (Kayne Anderson):

Have to have scale to be successful, must hedge oil/gas for as long as you can as much as you can

Target 8% distribution and have resulted 15% so far

Going forward they’ll be more prudent

They prefer older fields with less decline risk, vs newer wells that don’t have the full b factor defined

Jay Graham:

Spent too much for Percussion, pried Concho’s deal loose too

Targeting yield on a long term play

Jason Lindmark, Merit:

15x year fund life, prefer to operate

Any deal size is open… they’ll look at 1MM bolt on or $1.4B deal

Not having to pay for upside today

Yes, PDP deals in the teens (PV14, PV15, etc) are available but most quality production deals are closer to PDP PV10

Mark Teshoian (Kayne Anderson):

Kayne in fundraising their 2nd fund said they had over a billion $$ of money turned down from funds that wanted to invest but investment committees said no

Merit wanted $750MM, raised 930MM for their last fund

How to exit Merit’s assets from prior funds?

Asset securitization, go public, secondary market, etc

All options are on the table

Only 1/3 of the assets that came to market transacted, which is why Merit is flexible on exits

Matt’s notes:

Eagle Ford Panel:

There’s been a fair amount of animosity expressed towards banks / debt investors / Wall Street. During this panel, moderator Robert Urquhart (Scotia) felt the need to be defensive, stating:

“It’s tough - to speak for the banks - they’re not all evil”

Investing in PDP Assets Panel:

In contrast to Scotia, Kayne Anderson (who’s obviously more of opportunistic vs relationship) struck a different tone:

Mark Teshoian (Kayne): You’ve got hundreds of what I call “Zombie Oil & Gas Companies”

Later, after Art Krasny (Wells Fargo) commented that many E&Ps were strategically challenged, Teshosian said what everyone was thinking:

“You mean Shit-Cos”

There was more chatter in the room during the Investing in PDP Assets Panel than at any other point during the event.

While being overstated compared to the rest of the symposium, Teshoian may have still been understated, compared to reality.

Matt’s takeaway from the symposium is the E&P Catch 22:

E&Ps can’t pay back the debt; &

E&P Lenders don’t want to mark their books

The incentives are out-of-whack.

Coupled with PE firms marking portfolio assets above current NAVs, we’re going to be in E&P Zombieland until something gives.

At these commodity prices, it’ll probably be the cash balance in Zombie E&P bank accounts -

That’s it for this week - we’ll be back Tuesday - enjoy the weekend -