Crude Dissonance

“…there’s about 74 public independents (US E&Ps), there’s only gonna be about 10 left at the end of 2021, that have decent balance sheets…” - Scott Sheffield [03/26/2020]

***Editor’s note: if you find this newsletter helpful, forward it to friend or colleague***

If the invasion of Normandy was fought by today's leaders, the Americans - upon storming the beach - would’ve raised interested rates, while Germans would have fired back - purchasing Italian bonds.

COGNITIVE DISSONANCE.

Consider 3x statements, from:

The largest US bank;

The largest US hedge fund; &

A Texas grocer

Who’s who?

“We did not know how to navigate the virus & chose not to because we didn’t think we had an edge in trading it”

&

“We have no edge in predicting the course of COVID-19”

&

“We modeled [in January] what had been taking place in China from a transmission perspective, as well as impact”

The 1st statement is from Ray Dalio [Bridgewater].

The 2nd is from JP Morgan.

The 3rd is Justen Noakes, director of emergency preparedness at H-E-B.

***This is the 2020 version of the “Three Cowboys Around The Campfire” Joke***

Texas Monthly did an outstanding job, telling the story of H-E-B’s COVID-19 forecasting & risk management efforts - we strongly recommend the read.

But H-E-B’s response isn’t what interests us.

It’s the other two...

Epidemiology is about - like many other scientific fields - statistics.

**Statistics is what banks & hedge funds do**

There’s something going on here…

It feels a little like:

Cognitive dissonance

Group think

Baseless consensus

Why did JP Morgan & Bridgewater say the same thing?

And why did H-E-B get it right?

“Consensus reality is like paper money. It has no value except everyone believes in it. It has no real value, only pretend value, which is fine as long as everyone keeps pretending” - Jed McKenna

RIGHT NOW, we think something similar is happening with crude price & demand forecasts.

First, Vitol states that demand will drop by 20mm bopd.

And then:

Goldman says it will drop by 19mm bopd

The IEA says demand will fall by 20mm bopd

To us, there are 3x glaring errors in this situation:

You do not trust Vitol

You DO NOT trust VITOL

Has anyone checked what’s actually going on, on the ground?

Or is everyone simply repeating Vitol?

This week, we’ve heard:

Vopak (Rotterdam) is FULL

Trieste is a mess

And there are at least 80x tankers being used as storage

And - a South Texas refiner declined to give a crude gatherer a price, stating they were “full”.

All the while, “consensus price forecasts” for WTI & Brent are ~$20-25???

3BN people are at home, “social distancing”…

Gasoline & jet fuel demand will drop MORE than 20%

Refiners cannot run crack crude profitably until that demand recovers

And we’re weeks away from tapping out storage

And IF you find storage, are there any tankers left to ship the crude to storage?

The demand drop expectations & crude price forecasts do not add up.

What is the price if there are no buyers?

Something big has to give.

All of this reminds us of a recent comment, critiquing “climate experts”:

“One argument for a religious education… is to understand the strains of religious thought in nominally secular discourse” - Antonio García Martínez

In 2020, institutions have been pitching prayers as forecasts.

With the exception of H-E-B -

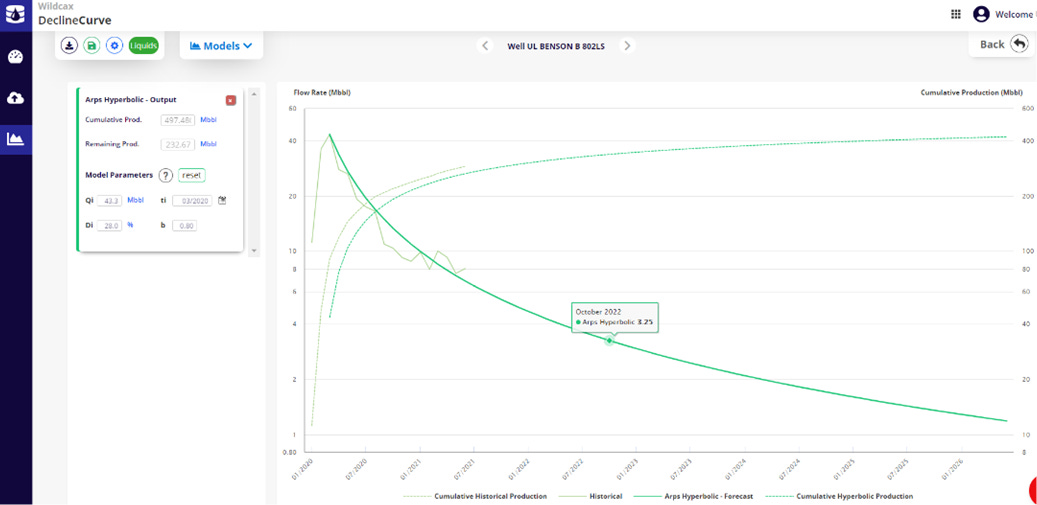

WHAT WELLS WORK AT $30: FANG.

Sunk costs are sunk (& excluded)

Used 2019 vintage wells

WTI, flat @$30/bbl

Again, we found that FANG’s IP180 rates varied widely.

However, on the wells we ran, Diamondback’s economics had a notably lower variance than Pioneer’s.

At a higher price scenario, consistency is worth something.

If you have a public company that you want us to include in the series, just add it to this form -

OTHER NEWS.

“A new bull market has begun. The Dow has rallied more than 20% since hitting a low 3x days ago, ending the shortest bear market ever” - WSJ [03/26/2020]

☝🏻 Markets can stay irrational longer than we can stay sane 👇🏻

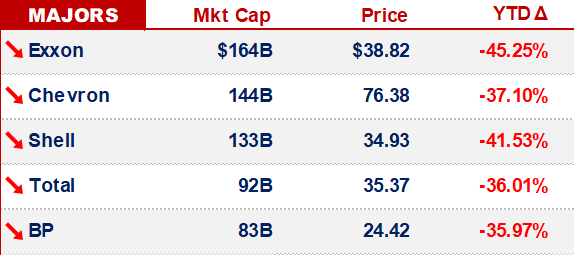

Last 72hrs: Chevron is +41%;

& WTI is -2%

Mexicans demand crackdown on Americans crossing the border

Zillow published pandemic / property price research

Find BAML’s Oil Inventory Monitor #491 & read it twice

Real time updates: GasBuddy & TankerTrackers

That’s it for this week - we’ll be back Tuesday - if you’re not caught up on Westworld, get to it already -