Crude Context

“Beware unexplained complexity, lest you confuse it for quality” - Jeremiah Lowin

***Editor’s note: Matt will be in Houston on Wednesday for the SPE-GCS A&D Symposium; if you’re interested in grabbing drinks after, at say ~5:30 to ~8:30, somewhere off of Main St. - shoot over a message via LinkedIn, Twitter, or email [crew@reservereport.co]; will post specifics in Tuesday’s newsletter***

EARNINGS.

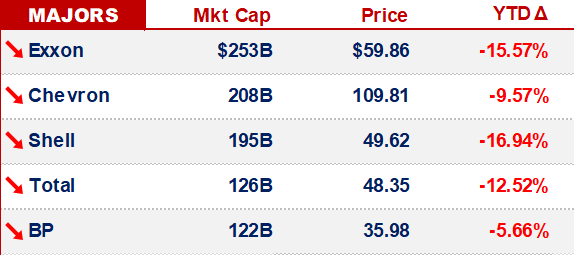

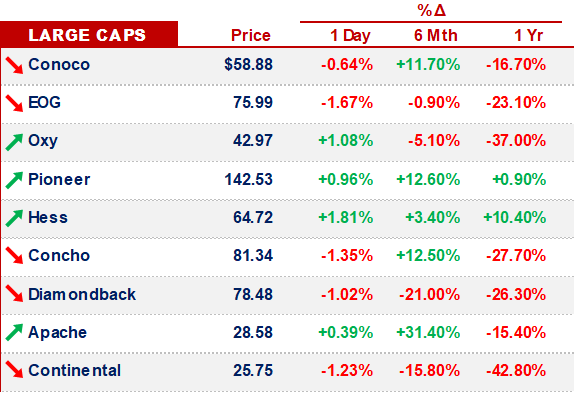

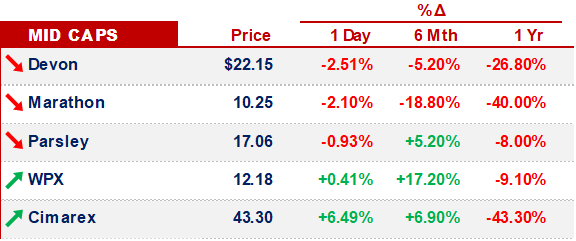

Majors / Large Cap E&P Earnings have been coming out for the last ~3x weeks…

…and shares have fallen ~5% - 20% since late Jan.

Considering the wider dispersion of returns that we’ve witnessed over the past year, this round of earnings has been…

…boring.

**And that’s a good thing**

However, the negative trend is noteworthy.

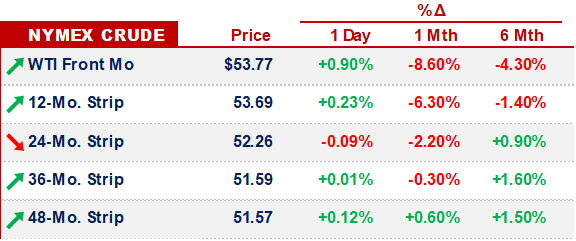

We believe it’s due to commodity market developments.

So, let’s take a closer look at Crude -

CRUDE DEMAND.

BAML’s Matt Zhao (matty.zhao [at] bofa.com) & Co put out a couple quality notes on Chinese demand:

China Petroleum & Chemical Industry Federation (CPCIF) on China’s private petrochemical producers, only 29% of them can operate at full production as of 12 Feb & 40% are still closed for production…

… CPCIF expects the negative impact on China’s private petchem producers to continue to worsen in the near future.

The common problems they face are:

constrained transport for raw materials and finished products;

product export constraints;

lack of demand from domestic market;

shortage of protective medical equipment, such as gowns, masks and gloves;

lack of working capital

The survey shows many regions are still restricting entry of trucks from other provinces and this affects the petrochemical producers who largely rely on road transport.

&

JLC [JLC oil analyst Ms. Wang Yanting] believes the COVID-19 outbreak will have a more negative impact on China’s refining sector than that of SARs outbreak in 2003, i.e. oil product output may decline by 30%+ YoY in 2M20, whereas during SARs, China’s output for gasoline, diesel and jet fuel declined by 12%, 11% and 26%, respectively.

Shandong teapots’ runrate dropped to 41% and SOE refineries’ dropped to 72% in mid-Feb, both at the lowest in 3 years…

…JLC’s channel check suggests all SOE refiners will not purchase 3rd party oil product in Feb and prioritize their own production. Some SOE-owned refineries may choose to do maintenance during this period of time.

CRUDE SUPPLY.

The good news for E&Ps is that - right now - the supply side of the crude world is messy:

Venezuela declared an Energy Emergency - production has dropped from nearly 3MM bopd in ‘14 to <1MM bopd;

Meanwhile, Iran - under US sanctions - has seen production drop from nearly ~4MMbopd to ~2MM bopd;

40% of Petrobras’s workforce had been on strike (although that wasn’t affecting production); &

And Libya…

Libya is going through a California divorce:

“[Khalifa Haftar] also ruled out a truce with “terrorists” and “Turkish invaders”, suggesting a near year-long battle will continue” - Reuters

Really, it’s been a mess for the last 9yrs.

The UAE, Egypt & Russia are backing General Haftar.

We think - with that backing - that he will fight until victory.

Libyan crude production is down 90%, to ~0.1MM bopd, since Haftar’s forces shut down exports, ~1x month ago.

For E&Ps, crude prices could be much worse -

OTHER NEWS.

Alix Steel interviewed Parsley’s Matt Gallagher - (skip to the 1:10 mark)

Scott Sheffield is calling for energy investors to sell shares or pull funding from companies that have high rates of gas flaring

Per Ryan Sitton’s report, the firms w/ the high rates would be smaller, private players

Chevron made an attempt at humor… we support the effort:

That’s it for this week - we’ll be back on Tuesday -