CRC Bankruptcy

“Regrets & recriminations only hurt your soul” - Armand Hammer

Filing Links:

CRC RSA link; Form 8K & Exhibits

Ch.11 Case Files; Case No. # 20-33568

Relevant Data: Dockets 1, 18, 22 & 40

Notes:

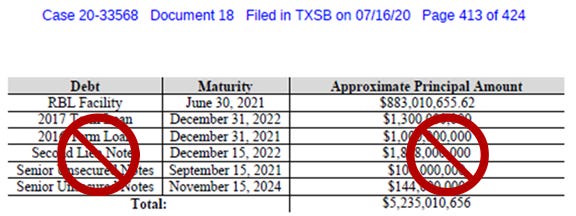

>$6.1BN in liabilities

Seeking to reduce obligations by >$5BN

‘17 Term Loan to get 93% of Equity

Relevant notes from Twitter

CRC CH.11.

California Resources Corp (CRC) - the original assets of Oxy - finally filed for bankruptcy.

It looks like the holders of the ‘16 term loan were hold-outs:

“…has entered into a Restructuring Support Agreement (“RSA”) with holders of approximately 84% of the Company’s 2017 term loans, 51% of the Company’s 2016 term loans…”

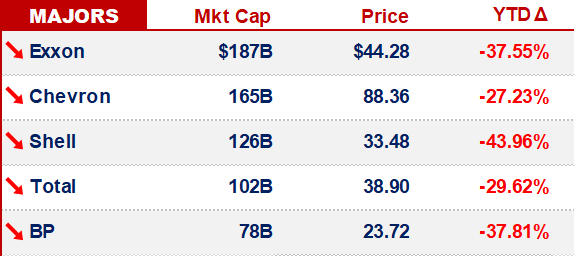

The downfall of CRC parallels the downfall of its former parent Oxy…

…it’s a story of poor strategic decision making:

Back in ‘14, CRC was spun-out of Oxy, with too much debt

Oxy in turn focused the company on the Permian

And then LBO’d Anadarko

None of those moves worked out…

The structure of CRC move - the leverage - was the issue.

Leveraging up a concentrated asset base…

It’s funny - that’s exactly the opposite of the strategy that made Oxy successful -

“From his earliest days as president of Occidental, one of Hammer’s overriding drives was for Oxy to diversify” - [attributed to Weinberg]

Hammer learned that lesson from many experiences, including Libya.

But we’ll be fair - there’s merit to the idea of having the concentrated assets of regulated company as isolated (geographically), so that its incentives are more aligned with the regulator.

That’s worked in places like France. And the UK.

But it doesn’t work when your regulator is Germany.

Or…

**California**

Those are the kind of regulators that necessitate diversification.

And adding leverage to the situation only makes those matters worse.

PG&E being the case-in-point.

CAPITAL STRUCTURE.

Before we continue, we’ll note that we believe CRC’s production / wells do have long-term economic value... assuming:

the right price; &

a manageable amount of debt

So - under those assumptions - we see a few relevant questions:

What ends up being the ultimate (36 mths from now) fulcrum security?

Will the RBL eventually be impaired?

What is the max leverage that the new RBL CA / other CAs will allow?

The last 10 years of distressed E&P investing can be characterized as underestimating the probability that bankrupt E&P pulls a Chapter 22…

…and given recent Ch.11s that we’ve seen, we think this will continue to be the case.

Hypothetically speaking…

If we (were investing &) weren’t a bank - and we could buy a slug of the RBL on the exit - that’s probably a decent place to be -

OTHER NEWS.

Marc Rich would be proud - an excellent story from Bloomberg, w/ a cast of characters including a sub-national MENA petro-state, Rosneft, Trafi & more…

Gunvor handled the Q2 vol

Warren Buffett on Nat Gas

Tight finishes coming in the PL & Championship - Tiger Woods is back (& -1) - that’s it for this week, catch y’all Tuesday -