Crack Spreads

“Doesn’t get much more 2020 than BRK buying gold miners and SaaS IPOs” - Brent Beshore

***If you enjoy this newsletter, do us a favor - send it to a friend or colleague***

REFINERY MARGINS.

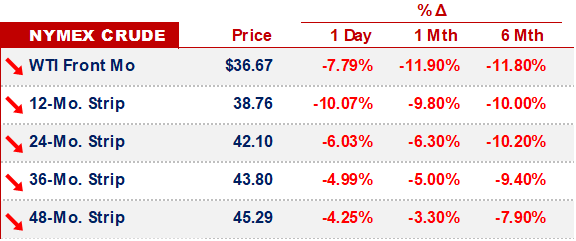

Brent Crude fell below $40/bbl, for the 1st time since July.

What’s happening:

August Chinese imports were 1MM bb/d < than July

Asian inventory is high

Saudis cut prices for Asia

All the while:

OPEC compliance remains high

OPEC is reportedly fishing for more cuts

And, traders don’t see the situation improving -

“The market is more complex and nobody knows when demand will come back. Financial investors are piling into second half of 2021 or Dec 2021 (oil futures contracts) on the assumption demand will be back then,” Marco Dunand, CEO of Mercuria, told Reuters.

“Coming into the fourth quarter, the expectation was that we should be drawing 3 to 4 MM bopd of crude and products from stocks but the market is not drawing that.”

Refiners are seeing margins weaken, on high stocks of refined products:

Correspondingly, Asian refinery buying is falling.

So long as economic activity is curtailed, crude prices will be under pressure.

On that topic…

UPSIDE-DOWN MARKETS.

The virus / vaccine / bailouts have dominated headlines, for a while now.

Most of it is noise.

There’s really only one question - in our minds - that matters:

Will current levels of deficit spending prove sufficient as a quench to increased withholding demand?

Intuitively, we think *no*.

But, we haven’t done any work on the subject… that’s just our unsubstantiated opinion.

Jesse Livermore, on the other-hand, just published what amounts to a small book (94pgs) on the topic.

Here’s a teaser:

“An upside-down market is a market in which good news functions as bad news and bad news functions as good news. The force that turns markets upside-down is policy. News, good or bad, triggers a countervailing policy response with effects that outweigh the original implications of the news itself.”

“Most investors are familiar with upside-down markets as they exist in the context of monetary policy. Bad news can function as good news in a monetary policy context because it can cause central banks to lower interest rates. If the boost from lower interest rates outweighs the negative implications of the news itself, then the overall effect on the market can be positive” - Jesse Livermore

[If you’re not familiar, Jesse Livermore is a pseudonym for an anonymous individual who collaborates w/ O'Shaughnessy Asset Management]

So, *that’s* what we’ll be reading this weekend.

A PDF can be found here -

OTHER NEWS.

Last week’s bit on the Bandwagon Effect almost timed the top…

It looks like one more party - SoftBank - hopped on the bandwagon before markets took a dive. There’s been a lot of noise around their trades - we found this thread to be the most useful -

That’s it for this week - tomorrow, the Chiefs begin their title defense - catch y’all next Tuesday -