Cimarex | Cabot

A merger arb, of sorts

Best take from the COG | XEC Deal Call:

Q: “What was the single biggest driver of the deal for XEC?”

A: “It makes us a better company”

@NextWaveEFT: ‘Nailed it’ (sarcasm)

CHANGE OF CONTROL.

Merger arbitrage usually refers to an investment strategy - whereby - an investor simultaneously purchases the stock of merging companies, *exploiting* market *inefficiencies* before a merger.

In the absence of a reasonable explanation for the Cimarex | Cabot merger, investors & analysts are voicing that the tables have been turned.

The merger appears to trigger change of control clauses.

And management appears to be using *the merger to exploit an executive compensation inefficiency*:

“Ryan Lance at COP had notoriously massive change of control of like $120MM at one point. They changed it, but at a glance he would get 2-3x his comp of around $30MM. So (COG) Mr. Dinges $40MM is... modest?” - Paul Sankey

In support of this argument is a history of alleged misalignment of incentives at Cimarex:

Since 2014, there have been 160 insider transactions at Cimarex:

152/160 were sales

Total sold: $85.2MM

Total bought: $570K - @EnergyCynic

The great thing about public transactions is that the market’s vote is transparent.

*Both* COG & XEC traded down ~7%, on a day when almost all other E&Ps were up -

DEMAND.

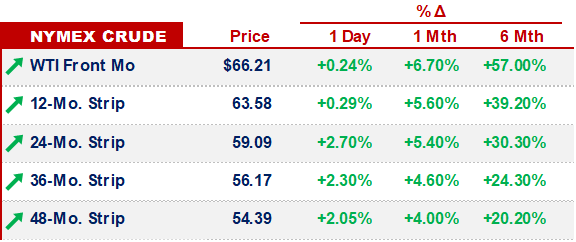

China’s oil demand has already reached pre-pandemic levels

US mobility recovered to 16% below pre-pandemic levels

Goldman sees oil hitting $80/bbl

Oil demand appears to be recovering faster than excess supply (Iran, etc.) is hitting the market.

We could go with more details, but - TBH - S&P put together an infographic that visualizes the story better than we can tell it.

Check out the infographic here -

OTHER NEWS.

Japan & others push back on IEA report

White House EO on climate

Bids come in for Shell refinery

Shell sells separate refinery to Pemex

That’s it for this week - we’re betting on Chelsea & ManU - catch y’all next Tuesday -