Chipping Away

“We are masters of the unsaid words, but slaves of those we let slip out” - Winston Churchill

ECONOMIC SHOCKS.

The world appears to be dead-set on supply, demand, & supply-chain shocks:

Covid-related trade disruption,

*Hopeful* energy policy, &

…are leading to:

Port bottle-necks,

Higher energy prices, &

Labor shortages (Uber drivers now make > than some banking analysts)

Right now, the semiconductor shortage is the supply problem in the world.

The shortage is is hitting everywhere…

…from server-farms to *farming* itself:

“The worldwide shortage of computer chips will impact all aspects of agriculture for the next two years and beyond. Almost every piece of farm equipment, like most everything else in our lives, needs a computer chips to operate.”

“Due in part to the Covid 19 Pandemic, there is a massive worldwide shortage of chips; and the industry is unable to meet the skyrocketing demand. Industry sources say the current shortage will not be resolved until sometime in 2022” - Gary Truitt

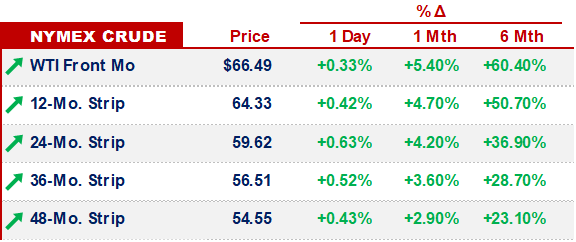

Assuming that gets solved, we expect that - in the long term - oil & oil products will take the pole position.

If governments even attempt to follow the IEA’s latest report guidelines, then the outcome would be something on the scale of the 1973 oil price shock (~300% price increases).

The press has even called out the absurdity of the report:

“Finally, the IEA has a credibility problem. The agency was saying the opposite (we need more investment in oil) as recently as 2017. So either it was completely wrong then, or perhaps it's now. But the old messages from the IEA, and the new ones are difficult to square” - Javier Blas, Bloomberg

Unfortunately, the world has been trending towards the absurd…

We’re reminded of the Hunter S. Thompson quote:

“When the going gets weird, the weird turn pro”

Today, there’s no shortage of policy “pros” doing weird things -

OTHER NEWS.

Michael Burry (of The Big Short fame) is massively short Tesla…

…that trade has functionally stolen the name “widow-maker trade” from those lost souls who’ve bet against Japanese government bonds…

The event has our attention -

On Montney well economics

The German / Coal drama continues

US lender recovery rates drop

Dutch Nat Gas trading booms

Gulfport is heading back to the NYSE

On the SPR drawdown

Ownership of US equities by age

That’s it for this week - we’re rooting for the Spurs & Golden State on Thursday night - catch y’all next Tuesday -