A Strongman Dance

“Show me the incentive & I will show you the outcome” - Charlie Munger

This week, we’ve been frequently reminded of a quote from Jean Cocteau, which roughly translates to:

“These events are beyond our understanding, so let’s fake being their instigator”

Accordingly, we’re taking headlines with a grain of salt -

THE NEW GAME IN TOWN.

The dramatic demand drop in oil markets has profoundly intensified the Games of Oil.

Before we dive into the maelstrom, we’re going to put the turbulence in context:

The premise of OPEC (and subsequently OPEC+) was straightforward:

Of singular importance to this game was that the Cartel had the capacity (and often the will) to curtail demand.

**THAT IS NOT CURRENTLY THE CASE**

The demand-shock from the Virus has overpowered the Cartel’s oligopoly power.

OPEC+ does not have the ability to cut production by 35MM+ bopd.

Nor do they have the incentive -

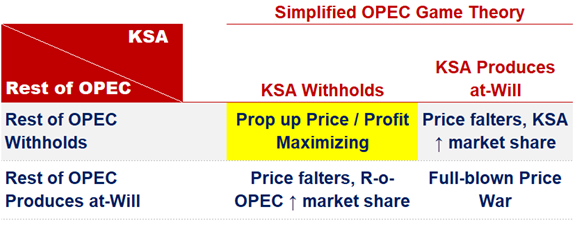

The above table describes a simplified version (on a relative basis) of the major players’ considerations, on the onset of this demand shock.

What was once a simple prisoner’s dilemma is now more complicated than a 19th century European land war.

Cooperative, Simultaneous, & Combinatorial contests are being fought on the national, sub-national & company level:

Where incentives align, cooperation will increase

And where incentives diverge, competition will be increasing fierce

Paradox has become a motive force within US E&P:

Pioneer & Parsley petitioned the TX RRC asking for proration

Then - Exxon, Chevron & other large players arrange a meeting at the White House today (the Sheffields apparently weren’t invited)

Exxon’s position is let the free market be free

Outside of the US, the games are more complicated.

There’s the currency variable.

For US players, profit = barrels sold x margin.

For international players, you have to add another dimension:

When the ruble devalues, Rosneft’s ruble-based expenses get cheaper.

To them, a $10 decrease in the price of oil coupled w/ a 15-20% ruble devaluation results in the same cash-flow (on a ruble basis).

And then…

Then there’s the Meta / Political Games…

Power, Influence… the stuff that money can’t always buy

The fight for your culture’s way of life…

Outside of oil, we’ve already witnessed one smash & grab job, on an EU democracy, nonetheless.

We won’t be surprised if we see a similar Coronavirus Coup…

Or even coups d'etat -

In any case, the idea that Saudi Arabia, other OPEC Members, Russia, China, non-OPEC exporters, and the US can somehow come to a meaningful agreement to curtail production seems very improbable:

In the US, it may be illegal / unenforceable

If Russia agreed, it would (relatively) help the US

If Saudi agreed, it would (relatively) help Iran

Given that the global decrease in demand is likely near 35MM bopd, low cost producers have a lot to lose:

They can still make money at these prices; &

They can kill their competition

There’s historical precedent, for the latter:

“In 1998 Saudi increased production significantly and global oil demand collapsed, in the wake of the 1997 Asian financial crisis, just as it appears to be doing now.

“The primary motivation at that time was to finally bring cheating vs. production quotas within OPEC to heal. It took multiple attempts to finally stabilize oil prices” - BAML

We’re not pretending to know all of the incentives at play, in this go-around.

The big ones, however, are in plain sight.

And, taking our blind spots into account, we just don’t see a group of Strongmen dancing - in sequence - to the tune of a 30MM+ bopd cut -

EQUITIES.

Taking a brief step away from oil -

In the latest edition of his “Invest Like the Best”podcast, Patrick O'Shaughnessy interviewed Gavin Baker (yesterday).

A few highlights:

“Valuation spreads within a sector, between individual stocks, are at all-time highs”

&

“You have peak volatility, peak valuation spreads, and then very high correlations, which means - when you put all of those together - this is the biggest opportunity if you’re focused on alpha or you’re a long/short investor…”

&

“It’s very rare that doing really obvious things generates alpha. At the beginnings of almost every bear market, doing the most obvious things works.”

“So - who crushed it for the first 3-4 weeks of this bear market?”

“People who sold all of their airlines, all of their travel related names, all of their cruise lines, and they went out, and they bought Target, Walmart, Costco, Kroger, Amazon, Netflix.”

“I’m sure most people thought about doing those things 3x weeks ago, but you never could have imagined that doing something that seemed so obvious would pay off to the extent that it did.”

“And yet that happens on the front end of every bear market” - Gavin Baker

We strongly recommend listening to the interview - Gavin gives a good overview of what’s been happening.

Specifically for equity markets -

FLOWS.

The lack of visibility into the intrinsic value of public equities has been approaching absurd levels.

In March - for the 1st time in over a decade - you could have made the argument that, at times, private fund marks presented a better reflection of intrinsic than public market valuations.

And not on the account that private marks were accurate…

...but on the account that public valuations were ridiculous:

Exxon increased 20%+ in value over 3x days

When over the same 3x days, WTI dropped -2%

Massive surpluses or deficits in liquidity - in many markets - have been the dominant drivers of price.

And in our search for more clarity on liquidity, fund flows data caught our eye -

Last week’s flows:

$25BN out of equities

$110BN redemptions from bonds (record)

$1BN into gold (only - surprisingly low)

$235BN inflow to cash (record)

Last 4x weeks equity flow drivers (from BAML):

We’re guessing that automated retirement contributions & employer EOY 401k matching (generally, companies have until March to pay employee expenses, for tax deduction purposes) made up much of those passive flows.

But that’s just our speculation -

WHAT WELLS WORK AT $30.

This week, we’re looking at Continental.

Sunk costs are sunk (& excluded)

Used 2019 vintage wells

WTI, flat @$30/bbl

It’s no secret that Bakken wells don’t work at $30.

What surprised was how much more consistent these wells were than ones that we previously looked at, from Pioneer & Oxy.

Simply, consistent cash-flows are worth more than inconsistent CFs.

And at a much higher price w/ real economics, we understand the argument for leverage on these wells -

GLOBAL STORAGE.

Last we heard, there’s ~800MM bbls of storage left for crude:

At a 30MM bopd surplus rate, that’s ~4x weeks to capacity

That assumes that infrastructure can get it there

Similar story for products:

~800MM bbls left for products

Should be slower to fill, as refineries cut runs

As infrastructure increasingly becomes the bottleneck to storage, expect differentials to widen -

OTHER NEWS.

To say that it’s been a busy week would be an understatement…

Some good news: Apache makes another Suriname discovery

On Sunday, Aramco is expected to slash prices again

Saudi has called for a global oil meeting

TX RRC is planning a public proration meeting on April 14th

Alex Cranberg wrote a letter in support of Pioneer to the RRC

US opened the SPR

Whiting filed for bankruptcy; more here

Erosion of trust in the WHO

Q2 GDP guestimates

New Howard Marks letter

And blissful ignorance, at sea

That’s it for this week - we’ll be back Tuesday - La Casa de Papel (aka Money Heist) is back for Season 4 on Netflix, so yeah… we’ll be chillin’ - enjoy the weekend -